Emerging Financial Insights for 2026

Introduction

As we charge toward 2026, the financial world is poised to embrace profound transformations driven by technology and innovation. From blockchain's ongoing evolution to the emergence of green finance, the landscape is more dynamic than ever. Investors, financial institutions, and even everyday consumers are navigating a shifting terrain as digital currencies pave the path for new economic paradigms. With macroeconomic conditions influencing global markets, understanding these changes is crucial. In this article, we will delve into these emerging financial insights, providing clarity and foresight into the anticipated trends. Here’s what to expect in the financial ecosystem by 2026.

Advertisement

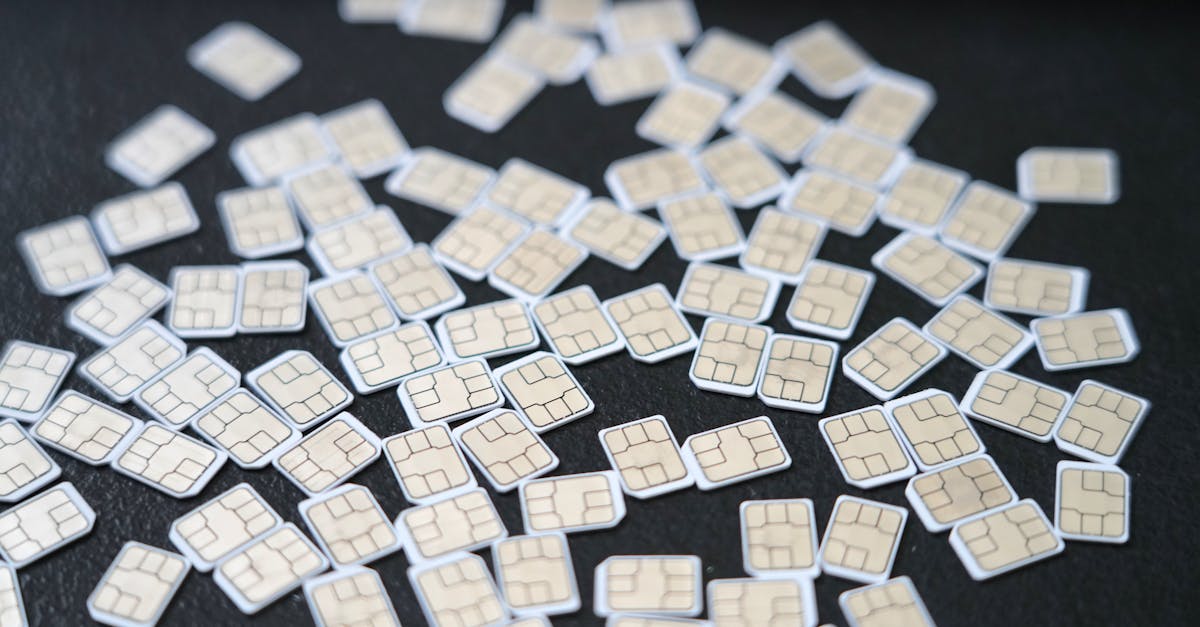

The Rise of Digital Currencies

Digital currencies like Bitcoin and Ethereum have set the stage for a radical shift in how transactions occur. As traditional currencies contend with the realities of a digital future, governments are exploring Central Bank Digital Currencies (CBDCs) to remain relevant. By 2026, many nations are likely to have launched their digital money, marrying the convenience of digital payments with state backing. These changes spell convenience for consumers, but they also come with regulation complexities and cybersecurity concerns. Nonetheless, digital currencies are paving the way for more inclusive and streamlined financial services globally, tapping into unbanked populations like never before.

Advertisement

Blockchain's Growing Influence

Besides powering digital currencies, blockchain technology holds promise for myriad financial applications by 2026. From facilitating smart contracts in real estate transactions to revolutionizing supply chain finance, the efficiencies generated may reshape industries. Beyond fintech, sectors like healthcare and manufacturing may harness this decentralized technology for faster, more transparent processes. Blockchain’s capacity to democratize participants’ access to data will transform auditing practices and regulatory compliance, promoting a more accountable financial environment. However, scalability and environmental concerns will need addressing to ensure sustainable growth.

Advertisement

The Shift to Green Finance

As concerns about climate change intensify, green finance has emerged as a pivotal trend moving into 2026. Financial markets are seeing a surge in Environmental, Social, and Governance (ESG) investments, as institutions are pressed to align with sustainable practices. Governments worldwide are rolling out incentives for greener projects, encouraging an influx in this segment. This trend not only heralds a wave of eco-friendly innovation but signals a larger shift towards long-term thinking in finance. While opportunities abound, challenges around standardizing ESG reporting and greenwashing accusations persist, necessitating vigilant oversight.

Advertisement

Artificial Intelligence Transforming Banking

Artificial intelligence is revolutionizing banking operations, from customer service chatbots to risk assessment algorithms. By 2026, AI could be central to identifying market trends, assessing creditworthiness, and personalizing financial products. This technological infiltration is expected to breathe new life into traditional banking by enhancing customer experiences, reducing operational costs, and mitigating risks through predictive analytics. However, data privacy, ethical considerations, and algorithmic biases will remain critical concerns, demanding robust governance frameworks.

Advertisement

Impacts of Global Inflation

Amid global economic recovery efforts, inflation remains an ever-looming challenge influencing financial strategies by 2026. Central banks worldwide are recalibrating policy measures to tackle this complex issue without stifling growth. Businesses are reassessing pricing strategies and expansion plans in the face of volatile commodity prices and currency fluctuations. Investors, too, are navigating treacherous waters, seeking refuge in commodities, real estate, and inflation-linked securities. As experiences from the past guide decision-making, the landscape for investors becomes one of balancing yields and inflationary pressures.

Advertisement

The Evolving Fintech Space

Fintech continues to democratize access to financial services, with innovation charting new courses into 2026. Whether it’s mobile banking apps or peer-to-peer lending platforms, fintech expands the reach of finance to underserved populations while offering unprecedented convenience. With venture capitalists heavily investing in fintech solutions, competition is driving rapid innovation and diversification of financial products. Traditional banks are partnering with tech startups to remain relevant, but cybersecurity and data protection are paramount as fintech becomes ingrained in everyday transactions.

Advertisement

The Role of Geopolitics

Geopolitical tensions and trade dynamics are omnipresent in shaping financial markets as 2026 approaches. Globalization, while declining in certain areas, continues to cause ripple effects across financial landscapes, affecting currency values and trade flows. Strategic alliances, policy shifts, and tariffs introduce new layers of complexity to global economies, demanding keen vigilance and adaptability from international investors. The intersection of politics and economics creates emerging opportunities and risks—essential for informed decision-making.

Advertisement

Regulatory Transformations Ahead

Financial regulations are set for significant refinement due to the changing nature of financial markets by 2026. Digital finance and ESG criteria are pressuring regulators to introduce more coherent, flexible frameworks that foster innovation yet protect consumers. As regulations evolve, financial institutions must remain nimble, navigating new compliance requirements that challenge legacy systems. While creating cost pressures, these changes promise to enhance transparency, accountability, and stability within financial systems. Proactive compliance strategies will be pivotal in seizing growth opportunities.

Advertisement

Conclusion

Emerging financial insights for 2026 reveal a rapidly advancing landscape marked by technological integration, regulatory evolution, and a vested interest in sustainability. Digital currencies, blockchain, and artificial intelligence are reshaping traditional paradigms, while geopolitical shifts and inflation guide market movements. Though challenges like regulatory complexities and ethical concerns persist, the financial world is poised for innovative growth. As stakeholders navigate these developments, informed adaptation will be key to thriving in the evolving financial ecosystem of 2026.

Advertisement