Future Financial Trends Outlook 2027

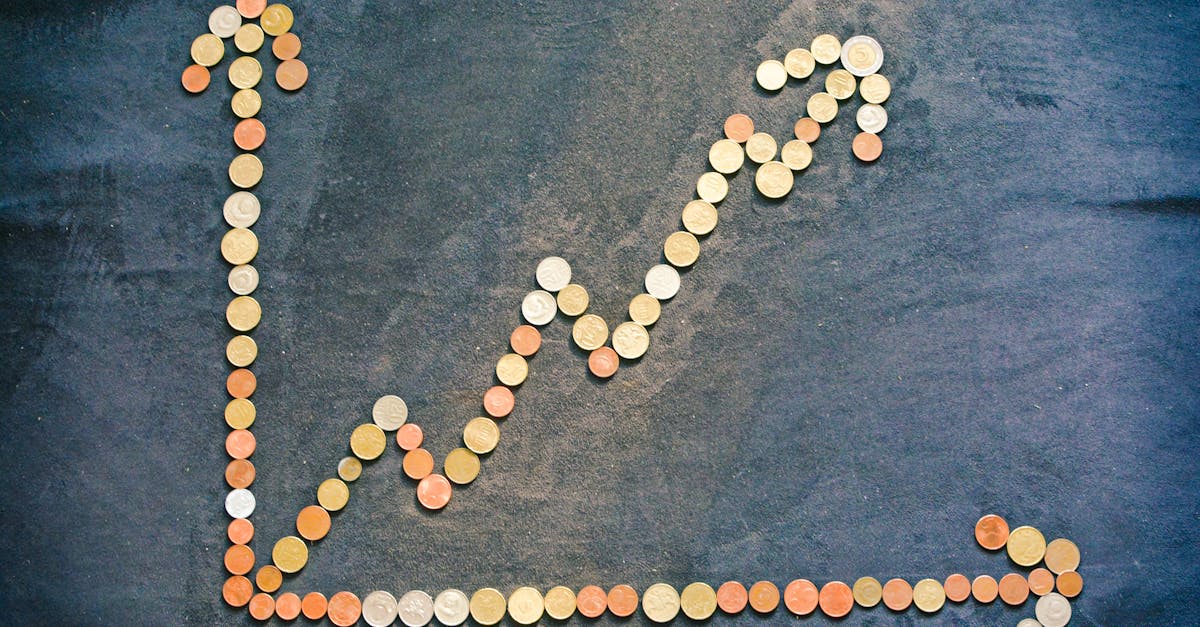

Introduction to Financial Trends 2027

The year 2027 may seem distant, but it's fast approaching and promises significant changes in the financial landscape. With rapid technological advancements, evolving consumer behaviors, and shifting global economies, it's crucial to anticipate what lies ahead. How will digital currencies reshape transactions? What role will AI have in financial decision-making? As much as challenges are expected, opportunities also abound. Navigating this future requires keen insight and adaptability. This article delves into various financial trends projected to define 2027 and beyond.

Advertisement

Technological Integration in Finance

By 2027, technology's integration within the financial world will have reached unprecedented levels. Fintech platforms, combining financial services with modern technology, will dominate the market, offering solutions that are both convenient and user-friendly. Blockchain technology, known for its transparency and efficiency, will become a mainstream tool across industries, ensuring secure transactions and tamper-proof records. As contactless payments become the norm, traditional banking models will either evolve or risk obsolescence, pushed by the demand for seamless digital experiences.

Advertisement

Rise of Digital and Cryptocurrencies

Digital currencies and cryptocurrency will gain enhanced legitimacy and acceptance by 2027. Governments worldwide might create their digital currencies, integrating them into their financial framework to control economic activities efficiently. Cryptocurrencies such as Bitcoin, Ethereum, and emerging coins will witness increased standardized regulation, which will drive broader adoption. This evolution will significantly affect cross-border transactions, providing faster, cheaper, and more transparent alternatives to current methods.

Advertisement

The Role of Artificial Intelligence

Artificial Intelligence will revolutionize the financial sectors by 2027, enhancing decision-making and risk management. AI-driven predictive analytics will aid in frontrunning market trends and optimizing investment portfolios. Robo-advisors will provide personalized financial advice, catering to individual needs at a fraction of the cost of human advisors. Furthermore, AI will enhance fraud detection mechanisms, curbing financial crimes effectively. These advances collectively promise a smarter and more secure financial system.

Advertisement

Impact of Climate Change on Financial Decisions

By 2027, climate change's impact on financial strategies will be more pronounced. Financial institutions will be more conscious about sustainable investments, carefully assessing environmental risks before lending or investing. Green financing and bonds will become increasingly popular as both consumers and investors lean towards eco-friendly options. This interest in sustainable finance will urge companies to innovate, transitioning to greener business models, further influencing financial strategies.

Advertisement

Evolving Regulatory Landscapes

The regulatory environment in 2027 will be dynamic due to technological progress and global interconnectivity. Regulators worldwide will work collaboratively to ensure that financial systems remain secure and resilient amidst these changes. Enhanced data protection regulations will govern digital transactions, ensuring consumer privacy and trust. As decentralized finance grows, regulations will adapt to protect users while promoting innovation. Thus, a balance between rigid frameworks and flexibility will be pivotal in the coming years.

Advertisement

Influence of Geopolitical Shifts

By 2027, geopolitical landscapes will significantly affect global financial systems. Economies will witness shifts as trade relations evolve, impacted by political alliances and economic partnerships. Countries will forge new agreements focusing on digital trade and economic cooperation. International tensions could lead to currency fluctuations, influencing global markets. These geopolitical dynamics will necessitate keen strategic foresight from financial institutions to navigate this complex environment confidently.

Advertisement

Focus on Financial Inclusion

Financial inclusion will take center stage by 2027, driven by technology and policy initiatives aimed at bridging economic disparities. Access to financial services will be democratized, thanks to mobile banking, digital wallets, and micro-financing. Emerging markets will benefit the most, witnessing improved access to credit and financial literacy. Governments and institutions will champion inclusiveness, understanding that broader participation in the economy fosters greater stability and growth.

Advertisement

Evolution of Consumer Behavior

Consumer behavior will shape the financial landscape significantly by 2027, as expectations of convenience, speed, and personalization grow. Empowered by technology, consumers will demand transparent financial services tailored to their specific needs. Millennials and Gen Z, becoming more financially independent, will influence banking transformation towards digital-first solutions. This shift will urge financial institutions to innovate constantly, offering solutions aligned with evolving consumer preferences.

Advertisement

Conclusion and Future Implications

As we look towards 2027, the financial world stands on the cusp of a transformative era filled with challenges and opportunities. The fusion of technology, eco-consciousness, and inclusive practices are reshaping the financial landscape. Institutions that adapt to these emerging trends will thrive, while those resistant to change risk obsolescence. Collaboration across industries and countries will be key to ensuring a resilient financial future. Ultimately, preparation and innovation will be the keys to unlocking potential growth in this evolving economic ecosystem.

Advertisement